Don't Miss The Biggest Wealth Transfer In Australian History -

An Advisory, Mentoring & Mastermind Program for Aspiring Business Buyers

Join Australia's Top Investors, Business Buyers & Buy-Side Advisors and Learn To Buy Profitable, Cashflow Generating Businesses — with minimal cash out of pocket

This is your fastest route to business ownership - With a clear, straight-line proven path to generating cashflow from day one.

CLICK BELOW TO WATCH FIRST!

Discover how we will advise, coach, mentor & guide you to acquire your first (or next) Profitable, Cashflow Generating Business... with minimal cash out of pocket.

(Without starting from scratch, investing thousands, or taking out huge personal loans.)

I'm looking for 5 aspiring business owners who want to buy their first business

Without Using Your Own Money... Risking Your Savings or Taking On Huge Personal Debt

Who is This Business Buying Advisory, Mentorship & Mastermind Program For?

Our program & community are designed for driven corporate professionals, seasoned business owners, and first-time entrepreneurs looking to acquire well-established, Profitable, and cash-flow-generating businesses.

CORPORATE PROFESSIONALS

BUSINESS OWNERS

Career Changers

Entrepreneurs

9 to 5 ers

Every Day Aussies

Side Hustle Seekers

Investors

AND MORE

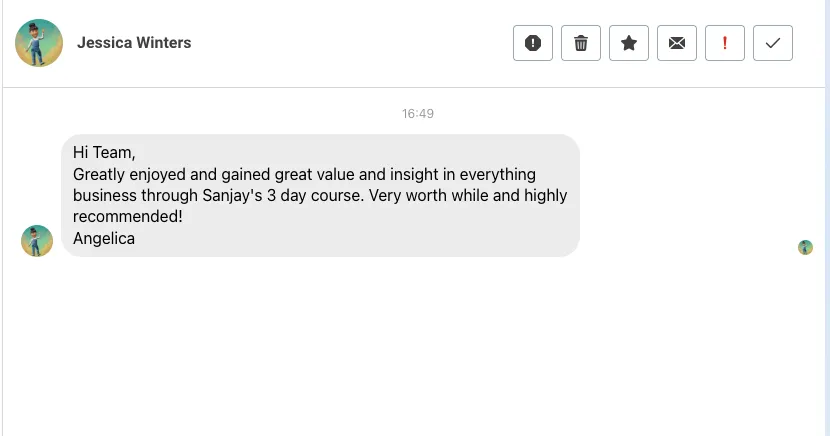

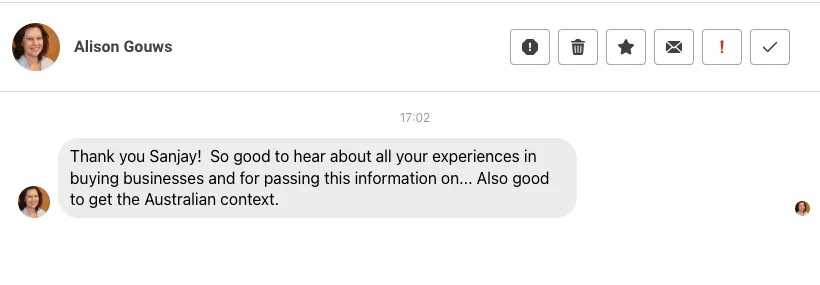

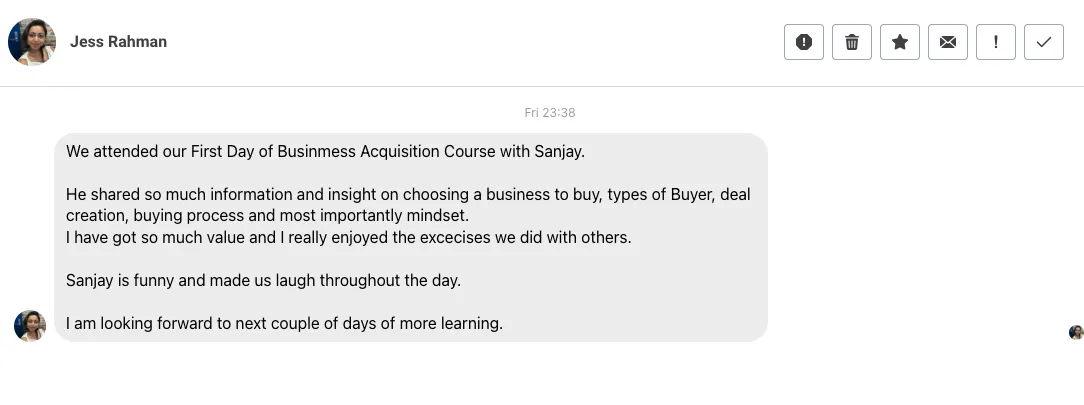

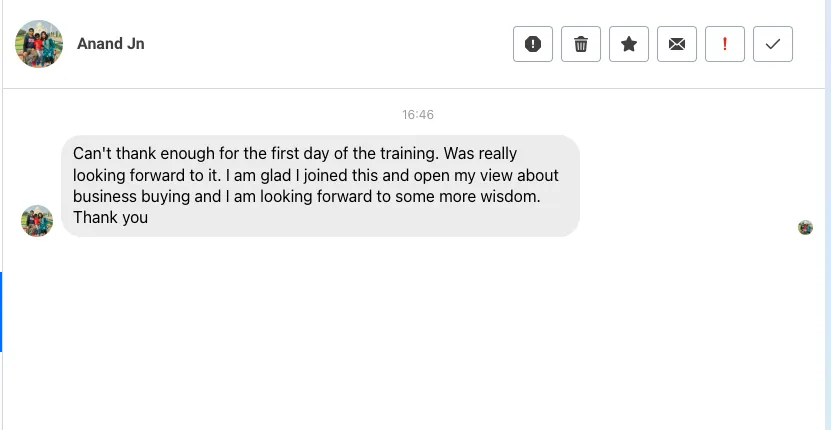

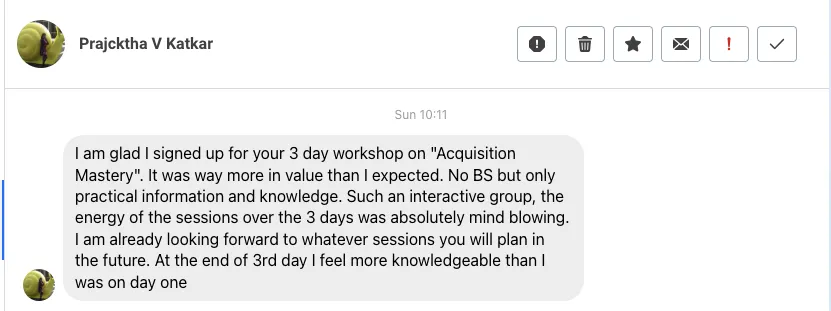

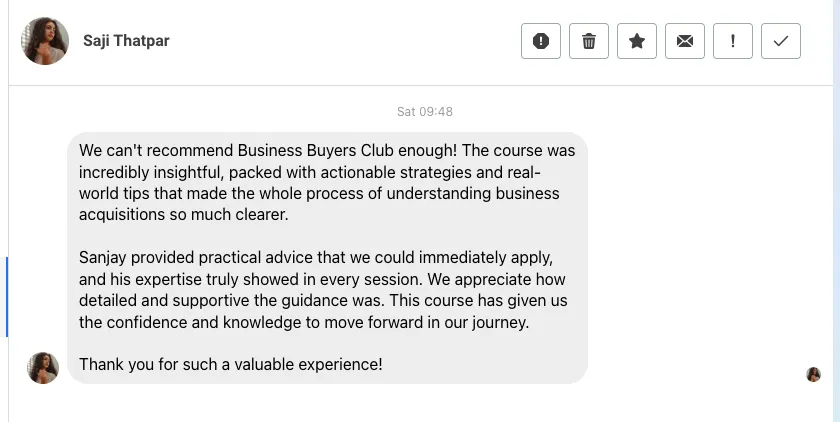

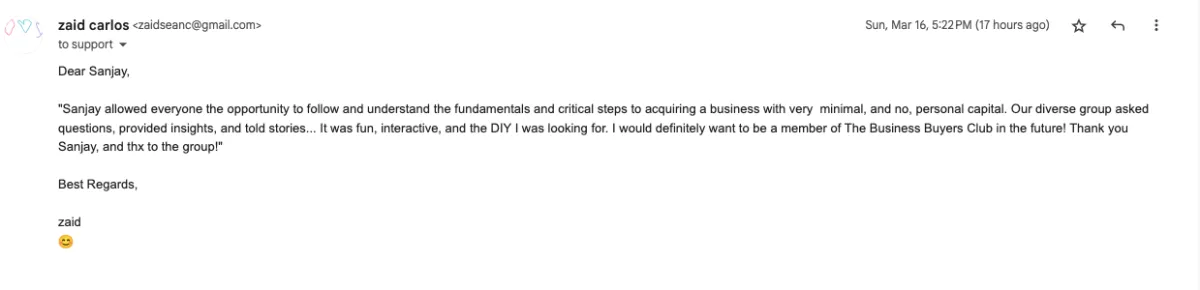

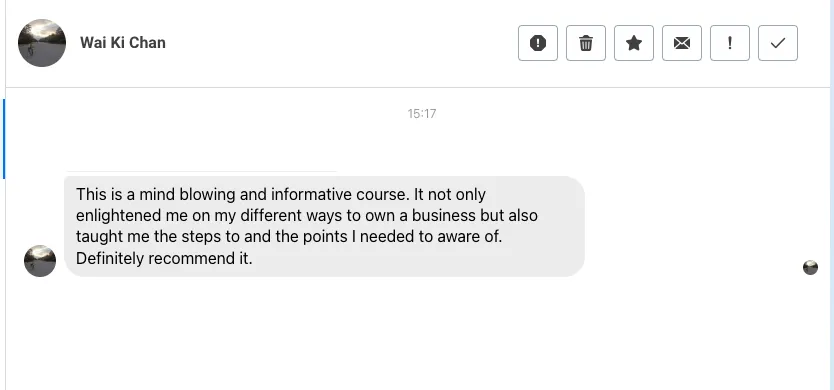

Hear from some of our most recent students 👇

The Next Steps

Book an Enrolment Call

Click "Apply Now" to book a discovery session where you can talk to one of our team members and share your goals.

Is BUYOUT For You?

Our team will align your goals and needs with our property development course and ensure BUYOUT is a good fit.

Start Buying

Upon enrolling you will receive immediate access to the training portal and a one-on-one introductory call with your designated coach

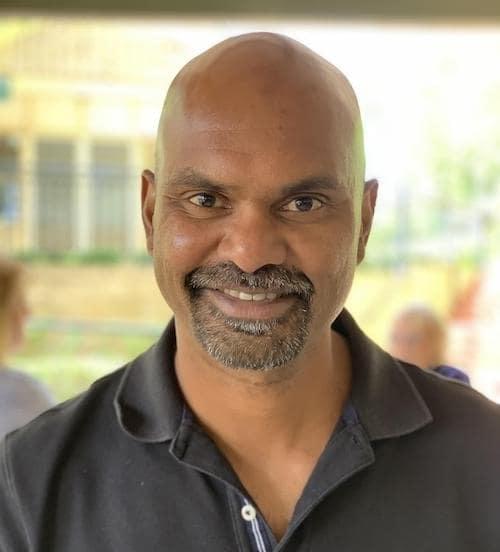

Sanjay Pandaram - Buy-Side AdvisoR

Who is Sanjay Pandaram?

Sanjay Pandaram is one of the Australia's most sought after Buy Side Advisors, having guided and lead some of the biggest business acquisitions in the world.

He is an accountant, investment banker, investor, business mentor and founder of the Business Buyers Institute - An Élite training organisation that teaches strategies used by investment banks & PE firms to buy highly profitable fully managed businesses without using their own money, risking their savings or buying the wrong business.

Sanjay Pandaram, often referred to as "The Acquisition Master", his impressive credentials include:

Certified Accountant (CPA )

CEO - Business Buyers Institute

Macquarie Bank - Head of Finance (Australia)

Lloyds International - Head of Performance (UK)

Citibank Asia Pacific - Head of Strategy (US)

Rabobank - Financial Controller (Netherlands)

Commonwealth Bank - Executive Manger Corporate Banking (Australia)

Orix Corporation - Finance Manager (Japan)

You don't have a money problem... You have a knowledge problem. We can solve that

Business Acquisition Course with Expert Guidance

Join our 12-month hands-on program that eliminates guesswork and equips you with the language, rules, feasibility, and resources needed for total confidence in business acquisitions.

As a BUYOUT Student, you'll gain exclusive access to my team, systems, and experts—learning the exact strategies behind how to buid and build your personal business empire. This intensive business acquisitions course gives you an advantage, guiding you step-by-step and giving you an option to acquire businesses with Minimal Upfront Personal Investment.

Business Buyout Program

Complete & implement the Mentorship Program and get the skills, strategy, and support to make your first deal a success!

What is included?

Personalised mentorship access to me to help you achieve your goals as quickly

Step-by-step training to buy just about any business

Weekly 'Live Deal Review' coaching & mentoring sessions to ask questions, so you never feel stuck

Complementary access to our deal team of lawyers, accountants and bankers

Fill-in-the-blanks Documents, Checklists, Scripts, Templates, and legal documents that tell you precisely how to get the best deal

Plug & play deal analysis tools and business valuation model

Access To Our Exclusive Members-Only Community of Deal Makers

Weekly Deal Review Advisory Calls

10 Critical Pieces Working Together for 12 Months to Buying Profitable Cashflow Businesses with minimal cash out of pocket

01: Market Research & Psychology

Learn the foundational mindset and knowledge needed to successfully buy a business, including the deal lifecycle and what it takes to run a company.

Why acquisition entrepreneurship?

The Acquisition Entrepreneur Mindset Pillars

The deal journey & lifecycle

Do you have what it takes to run a business?

Resource: Action Steps Checklist

Resource: Acquisition Journey Reference Sheet

Resource: Acquisition Self-Reflection Worksheet

02: Deal Clarity - What To Buy

Gain clarity on your personal acquisition criteria using the Business Buyers Institute Deal Clarity Framework, focusing on income goals, skills, and target industries.

Get clarity on why you want to own a business

Characteristics of the business you should buy

Which industries you should target

Create your own Deal Box to find your ideal business

Resource: Zone of Genius Worksheet

Resource: Deal Clarity Worksheet

Resource: Industries Database Selector

Resource: Personalised Deal Box

03: Deal Origination & Identifying Off-Market Opportunities

Discover techniques for finding on-market and off-market deals that fit your criteria, and learn to track deal flow using the Contrarian CRM Database

How deal sourcing works: finding businesses to buy

Finding deals through marketplaces like BizBuySell

How to find off-market deals

Other methods for finding off-market deals

How to track if you’re making progress in business buying

04: Connecting Directly with Motivated Sellers (no brokers)

Master the art of positioning yourself as a qualified buyer, engaging sellers, and building relationships with owners and brokers.

How to position yourself as a qualified buyer

How to engage with sellers (including scripts)

Methods for meeting sellers

How to get responses from on-market deals

Resource: Buyer Profile PDF

Resource: Cold Email Outreach Scripts

Resource: Questions to Ask Sellers

05: Business Valuation & Financial & Performance Analysis

Learn to evaluate potential deals, sign NDAs, assess valuation using cash flow and market comparables, and decide whether to make an offer.

How to assess valuation before submitting an offer

Methods for assessing valuation

How to calculate SDE

The 10 Contrarian Business Value Markers Framework

How to quickly crunch the numbers on a deal with our deal calculator

Resource: NDA Template

Resource: Deal Calculator

06: Funding With Limited Personal Funds

Explore the main acquisition funding methods and specific financing strategies, including seller financing, Reverse Funding loans, and sweat equity.

Learn the main ways deals are financed

How & when you should leverage debt to finance your deal

How to combine debt & equity

Deep dive into seller financing

Deep dive in sweat equity

Resource: Financing Options Sheet

Resource: Expertise to Equity Terms Worksheet

Resource: Seller Financing Avatar Checklist

07: Strategic Offer & Negotiation

Understand the differences between LOIs and purchase agreements, structure creative deals, make offers, handle counteroffers, and negotiate win-win outcomes.

How & when to use professionals at the offer stage

What to include in your LOI (with templates!)

When to use LOI

What money is at risk during this stage

How to present your offer

How to negotiate your offer with sellers

Resource: Offer Checklist

Resource: LOI Template

08: 3 Levels of Due Diligence

Navigate the due diligence process, build your deal team, evaluate key information, and identify potential issues or red flags.

How to perform due diligence

How to build your deal team to verify due diligence

What information to look for during due diligence

Resource: 60+ item due diligence checklist

09: Closing & Takeover

Master the formal closing process, resolve outstanding issues, finalise legal documents, and understand legal structure and purchase price allocation.

Learn how the closing process works

How does legal take over structure work during closing

Who are the key people involved in closing?

Models: Services, products and systems

Resource: Closing checklist

10: First Year of Ownership

Prepare for the transition to ownership by completing essential tasks and setting the stage for a successful first day.

What do you do on day 1

How do you prepare to operate the business

Resource: Takeover checklist

See What Investors, Business Owners & Executives Are Saying About Our Mentoring & Coaching

Your strategies helped me buy a No Money Down business!

Following your advice has resulted me to acquire my 1st 'No Money Out Of Pocket' business. Thanks for the continued support.

⭐️ ⭐️ ⭐️ ⭐️ ⭐️

Aaron S.

Your workshop gave me the clarity I was seeking

This was a wonderful workshop! It's the clarity I was seeking. Now I know what I need to do. Thanks for all the great training you put on.

⭐️ ⭐️ ⭐️ ⭐️ ⭐️

Colleen P.

Trainings that provided REAL value & actionable steps!

You guys CRUSHED the training today. I can honestly say that you guys genuinely care about the results we get. You guys are just amazing.

⭐️ ⭐️ ⭐️ ⭐️ ⭐️

Greg S.

You guys doing something no one else is doing!

I must say, you doing something no one else is doing. What you showed me was a real eye opener. I wish I had learnt this when I was younger... but better late than never...

⭐️ ⭐️ ⭐️ ⭐️ ⭐️

Cathy T.

I just bought my very first business...

I've been looking for the best way to get into business. With your help, I bought a new business.... with no money from me! This has changed my life forever and I can't thank you enough.

⭐️ ⭐️ ⭐️ ⭐️ ⭐️

Jenny D.

The future for my family and me looks bright

I came to here with my family because we wanted a better life. And have a better lifestyle. What you guys taught me has enabled me to realise that dream. Thank you. Thank you. Thank you

⭐️ ⭐️ ⭐️ ⭐️ ⭐️

Rajeev S.

I learnt more from your presentation than I did at Uni...

The business classes I took at Uni are a joke compared to what you teach. Seriously. This is a game changer for me. Real. Practice. Concise.

⭐️ ⭐️ ⭐️ ⭐️ ⭐️

Mike P.

Thanks so much for an awesome workshop

Thanks so much for the fascinating workshop today. I've been looking for something like this for a very long time... and finally I found you guys

⭐️ ⭐️ ⭐️ ⭐️ ⭐️

Wendy D.

Why don't they teach this stuff at school instead of crap

This is real education. This is what people need to learn. I wish the Government would have you guys teach this in schools

⭐️ ⭐️ ⭐️ ⭐️ ⭐️

Ryan R.

Frequently Asked Questions

Are you Australian?

Absolutely — our HQ is in Sydney, but we work with clients all across Australia.

What is included in the BUYOUT program?

It’s everything you need to go from “I know nothing about business acquisition” to becoming a confident business owner, investor, and entrepreneur.

We’re constantly improving the program, but as of July 1, 2025, here’s what’s included:

⸻

🔒 Private Community (Where the Magic Happens)

This is where deals are made, strategies are shared, and progress happens fast.

Our members are active across industries — from eComm, landscaping, and real estate to laundromats, hotels, bakeries, and professional services.

This isn’t a dead forum. It’s an active dealmaker’s network hosted in Slack — where members collaborate, partner, and hold each other accountable.

⸻

📞 Weekly Live Calls (Every Wednesday)

Our live group calls are the heartbeat of the program.

Each week we:

• Review real deals in progress

• Share recent wins from members who’ve closed businesses

• Bring in guest experts (lenders, M&A lawyers, roll-up strategists, tax advisors, and more)

It’s hands-on, high-value, and highly practical — and yes, it’s a lot of fun too.

⸻

📄 Tools, Templates & Legal Docs

Get instant access to the essential documentation you need to assess, structure, and close deals:

• Cash Flow Calculator – Quickly assess whether a deal is worth pursuing

• Financial Modelling Tool – Forecast 3-year performance and plan your growth trajectory

• Legal Templates – Letters of Intent, NDAs, Due Diligence checklists, and more

• Proprietary Tools – Custom-built resources to de-risk your acquisition and move with confidence

⸻

🎓 Full Online Course (All-Access)

Think of it as an MBA you can actually use.

Work through 10 core units at your own pace, covering everything from:

• How to find the right businesses

• Negotiation and deal structuring

• Funding strategies with minimal personal capital

• Your first 180 days as an owner

Plus, 40+ bonus trainings, with more added regularly.

⸻

This isn’t just theory.

It’s a full system to help you find, fund, and close your first (or next) acquisition — with real support every step of the way.

How Does It Work?

As soon as you enrol, you’re plugged into our private Skool community — with instant access to past deal breakdowns, bonus trainings, templates, legal docs, and recordings of every workshop we’ve ever run. You also unlock our live advisory calls and expert Q&As from day one.

So if you’re keen to get started early, you absolutely can. Watch the replays, join the calls, ask questions, and even start analysing real deals — before we officially kick off.

But the real engine of your progress is our weekly live Advisory Calls — where we roll up our sleeves with you and other serious buyers to break down deals, troubleshoot offers, map out financing strategies, and answer your toughest questions. Whether you’re writing your first outreach message or structuring a seven-figure buyout, this is where the magic happens.

From there, you’ll have 12 full months of hands-on support — via the Skool platform, weekly calls, deal reviews, expert office hours, and direct access to your advisory team. Need help analysing a deal, crafting an offer, or speaking with a seller? We’re in your corner the whole way.

This isn’t just education. It’s execution.

How much does it cost to join the program?

The investment ranges from $5,000 to $8,000, with flexible payment options available.

Does the content, support, training & networks apply to Non-Australian markets?

Our knowledge base of transactions is specific to the Australian market. Our tools are designed for the Australian legal system as well as Australian financial markets.

How quickly can I get results?

Let’s be real — this isn’t about buying any business. It’s about buying the right business. And that takes strategy, patience, and execution.

Most members start seeing meaningful traction — seller conversations, early offers, or even deals under contract — within 3 to 12 months. That’s the typical window. Not because the process is slow, but because we focus on helping you make smart acquisitions, not rushed ones.

That said, if you’re proactive — attending calls, reviewing deals, implementing the frameworks — you’ll likely make faster progress than most.

Some members have sourced leads and booked meetings in their first week. Others closed their first deal in month three. The difference isn’t luck — it’s implementation.

So how fast can you get results?

As fast as you’re willing to do the work — and as focused as you are on buying the right business.

Is there a common reason why the members who haven’t closed/ bought a business haven’t done so?

The primary reason people don’t close/buy a business is that they give up and chase the next bright, shiny object. While we give you all the tools and training, we cannot force you to do the work.

Like everything worth doing, buying a business takes time and dedication.

What kind of support do I get ?

You’ll have two main avenues of support throughout your 12 month journey — the Skool community and our live advisory calls.

Inside the Skool platform, you’ll be surrounded by experienced acquisition entrepreneurs, vetted professionals, and our full advisory team. Whether you need help structuring an offer, reviewing financials, or just want feedback on a deal — someone from the team will jump in with answers, typically within one business day.

But where the real magic happens is on our two weekly live advisory calls.

Bring your deals, your outreach scripts, your seller emails, your LOIs — and we’ll workshop them with you, live. You’ll get direct, tactical feedback on everything from valuation to negotiation strategy, deal structure to financing options. If you’re stuck, we’ll help you move forward. If you’re ready to go, we’ll help you close stronger.

Most members lean heavily on these calls in the early stages — and we encourage that. Over time, as your confidence and skill grow, you may just drop in for a tune-up or to pressure-test a big decision.

In short, you’re never doing this alone. We’re in your corner, every step of the way..

How long do I get access to the training and support?

The Mentorship Membership runs for 12 months, with the option to renew if certain criteria are met.

Remember — buying and operating a business is a long-term game. It’s not a quick win or one-and-done. We’re here to support you through the entire journey.

Is this content, support, training & networks specific to only certain types of businesses?

Nope! We have students acquiring in every vertical across every market imaginable. We don’t specialise in a single industry, location, or type of business. Most of our members are looking at traditional businesses; however, many are open to remote workforces or online businesses.

How much time will I need to dedicate to the buying a business?

The initial intensive requires a commitment of 1 to 2 hours per week. Live workshops are held during the week. The live workshops are weekly on Wednesdays at 12:30pm Sydney time. More time will be needed as you meet sellers, negotiate and start doing deals.

What tools & resources do I get access to as a member of the BUYOUT program?

10 step Acquisition Accelerator Intensive with proprietary content on how to buy a business that cannot be found elsewhere:

One-on-One with Advisor to Develop Value Proposition Buyer Profile

Live Q&A with Lending Partner

Weekly Live Ask-Me-Anything with Sanjay

Deal Evaluation Workbook (Cash Flow Calculator, 7 Elements, Business Mapping, etc.)

Financial Analysis Tool (3 Year Forecast, Break-Even Analysis, Scenario Planning)

Real Life Case Study to Gain Hands On Experience Evaluating Deals

Self-Evaluation Workbooks

Outreach Tools (Scripts, technology, etc.)

Legal Templates (LOI, Due Diligence Checklist, etc.)

Deep Dives into Member Deals

Access to live call recordings

Vetted Network of Service Providers (lawyers, accountants, lenders, etc.)

Private Skool Group & Highly Vetted Community

What if I don't have a lot of experience?

No problem! The course is beginner-friendly and offers a step-by-step system.

Can I use this even if I don't have experience in business acquisitions?

Yes! We're teaching you everything you need to know step-by-step for beginners or business acquisitions. PLUS giving you access to our community to help you along the way and hold your hand to win on deals.

Do you provide post-close support?

The services of the Mentorship officially end at closing. However, you’re more than welcome to continue dialing into our Live Deal Review/Search Forum call and asking any questions that may come up.

Who created M.U.P.I ?

M.U.P.I. was created by Sanjay Pandaram. M&A expert who has helped everyday Aussies discovering this unique method for buying business.

Where will I receive the M.U.P.I. training?

You will get instant access to our Skool group when you sign up to be able to view the trainings and materials.

Is there a guarantee or refunds or Trial Periods?

As this is a digital training and coaching program, we do not offer refunds or guarantees.

Is there one-on-one support for my deals?

Yes – from our advisory team and from other members if you take up the mentoring option.

Our program is built around the value of group learning. While we are always available as a thought partner to discuss listings or deals, best practice is to lean on your club members as well as our advisory team for feedback on deals. The value of the club is that everyone learns from everyone’s deals so we try to limit the one-on-one sessions as much as possible and/or highly encourage our members to take aspects of the discussion to the Skool channels to gain insight from other members and our advisors.

What stage of the process are most of your members when they join?

We get members who are in all stages of their search.

We have some experienced acquisition entrepreneurs who join after acquiring other companies because they want the structured framework and community. We have others who know they want to acquire a business but nothing else is figured out yet other than they have the money to do so.

We also have people who join the Club even after they are under LOI. Those members are given access to the advisory services a little early because our primary goal is supporting your deal.

As a result, we will move you around the Club as much as necessary to get you the required support but you’ll fall back into the natural cadence of your cohort, too.

Do members compete for deals within the BUYOUT program?

Because of our focus on understanding your unique value proposition as a buyer, we find that our members have so far NEVER competed on a deal.

Because both members may be looking for the same type of business but have completely different value propositions – it makes it unlikely that it would be a great fit for both.

For example, if one member is looking for a manufacturing company to do process improvement work and the other is looking for a manufacturing company to implement a sales strategy and hire sales staff then a business would not be attractive to both people. One would be attracted because he saw sales potential and the other would be attracted because it already had sales in place but needed some refinement around operations.

Do you help with funding the deal?

We have finance brokers who can help you with acquiring finance. The whole goal is to try to acquire a business with minimal personal investment. Acquisition outcomes vary and are subject to numerous factors, including the nature of the business, financial performance, seller terms, and your personal circumstances. While we teach strategies aimed at reducing upfront investment, no money down deals are uncommon and not guaranteed.

Do I need to work in the business I am acquiring?

That is an individual choice. Some of our members do, others have managers to run the business and other plan work in the business at a later stage.

How do I know what industry to target or what size deal I should buy?

This is one of the most challenging aspects of your journey. It’s the primary reason why we spend a lot of time wit your Acquisition Criteria. We feel like understanding who you are as a buyer is the biggest risk mitigation strategy that there is – you are the biggest risk in any transaction you do.

By the end the Acquisition Criteria exercise, you’ll have greater clarity around both of these components. After working one-on-one with our branding advisor, you’ll have a completed buyer profile that gives you confidence in your ability to execute.

Why should I join your BUYOUT program instead of someone else in this space?

We consider the Business Buyers Institute to be one of the most high-end mentorship experiences on the market today. But let’s be honest — every provider in this space serves a different niche and offers varying degrees of support and hand-holding.

Where we’re different is in the depth and quality of support we provide.

Our advisors are what truly set us apart.

They’re not just instructors — they’re active practitioners, successful buyers, and skilled mentors who’ve walked the path. And they bring that real-world experience to every call, question, and deal review.

We chose the name Institute for a reason:

There’s no single “right” way to acquire a business. Our members benefit from a diverse range of perspectives and strategies — shared openly by a team of experts and a community of experienced operators. You decide what works best for you, but you’re never short on insight, perspective, or support.

The goal is simple: You’re never left spinning with unanswered questions.

Whether it’s in the live calls, the private community, or deep-dive deal reviews — there’s always somewhere to turn for guidance.

This program is built for people who are collaborative by nature.

You might know you could figure this out alone — but you don’t want to. You want to surround yourself with others who are doing the same thing. Because business buying is a lonely path… and most of us can’t exactly chat with our neighbours or mates about due diligence or vendor financing.

This is your sounding board, your support system, and your inner circle — made up of people who have done it, are doing it, and are here to help you do it too.

It’s a high-touch, high-calibre experience for those who are serious about acquiring.

Do you guarantee success?

If you’re the kind of person who delegates your success to others, this isn’t for you.

Let’s be clear — we can’t (and won’t) guarantee your success, results, or income. No one can. Your outcomes are entirely in your hands.

We’ll give you the recipe.

We’ll show you the ingredients.

We’ll even stand beside you in the kitchen.

But you still have to cook the meal.

Think of us as your Gordon Ramsay — guiding you with precision, calling out mistakes before they cost you, and cheering you on when you close your first deal.

This is a hands-on experience. We’re here to support you, but you have to show up, do the work, and take ownership of the outcome.

How do I get started?

Click the button below!

Before you talk to our enrolment team

[Read First 👇]

If you don’t know what we do, spend 60 seconds to scan through this page, read the FAQ, program details above, etc.

Pls Note - This Is NOT an Ineffective 3-day building your empire BS course from a Marketing Guru that “upsells” you every step of the way. This 12-month mentoring program costs between $5,000 - $8,000. (payment options available)

Finally - this call Is NOT to get Free Advice. This call is purely to see if we are a mutual fit for each other and for you to decide if you wish to join our 12-month coaching and mentoring program.

Take the next step... ONLY if you are serious about learning how to buy businesses... the right way 👇