Don't Miss The Biggest Wealth Transfer In Australian History -

For Aspiring Business Buyers WITHOUT Deep Pockets

Buy a Profitable Cashflow Business - with Little To No Money Down.

— With Step-by-Step Coaching and Mentoring, We’ll Show You Exactly How to Secure Cashflow Businesses... EVEN if you don't have thousands to invest.

(Without starting from scratch, investing thousands, or taking out huge personal loans.)

I'm looking for 5 aspiring business owners who want to buy their first business

Without Using Your Own Money... Risking Your Savings or Taking On Huge Personal Debt

NEXT STEP: Answer a Few Quick Questions to Get Matched with Your Mentor and Start Your Journey to Business Ownership Today

CLICK BELOW TO WATCH FIRST

"We’re on the middle of the biggest wealth transfer in Australian history — with over $500 billion in Baby Boomer-owned Businesses up for grabs.”

— KPMG & Australia Bureau of Statistics (ABS) data.

STILL NOT SURE?

Answers to the Questions Every Future Students Asks

What kind of business do you recommend I buy?

This is the most important part of the entire process — and it’s something we spend a lot of time helping you get right.

The truth is, the right business for you may not be the right business for someone else. It’s a deeply personal decision that depends on your income goals, lifestyle, experience, and appetite for involvement.

That said, there are certain non-negotiables we look for in every business we buy. These are the foundations that make the deal both safe and profitable:

1. Well-Established – The business must have at least 5 years of trading history. We want proven, not speculative.

2. Profitable – No turnarounds, no hope-based plays. The numbers must stack up.

3. Immediate Income – It should generate an income stream for you from day one.

4. (Optional) Managed – Ideally, it can afford to pay a manager to run the day-to-day, so you don’t have to.

5. Cash-Flow Funded – Most importantly, the business must have enough cash flow to cover the cost of acquisition. In other words, the business pays for itself.

We guide you through the process of identifying and securing a business that fits your personal criteria and meets these financial and strategic standards.

What types of businesses do your clients buy?

Our clients buy profitable, established, cash-flowing businesses across a wide range of industries — but they all follow the same key criteria.

We don’t focus on “sexy” startups or risky turnarounds. We look for boring, proven, and profitable.

Some examples of businesses our clients have acquired include:

• Commercial cleaning companies

• Trades and services (plumbing, electrical, HVAC)

• Allied health clinics

• Automotive services (mechanics, car washes)

• Manufacturing and light industrial

• Transport and logistics

• Business services (IT, bookkeeping, digital marketing)

• Wholesale and distribution

• Childcare and education businesses

The industry itself is often less important than the business fundamentals — recurring revenue, consistent profit, strong margins, and systems that allow for management (rather than hands-on operation).

We help you match a business to your income goals, skill set, and lifestyle — and ensure it meets the core financial criteria so it can pay for itself over time.

What size of business do your clients buy?

Our clients buy businesses that typically range from $500K to $25M+ in revenue — depending on their goals, experience, and capital strategy.

Here’s a general breakdown:

• $500K–$5M Revenue / $150K–$1M Profit

This is the most common range for first-time buyers — businesses that are established, profitable, and can fund their own acquisition.

• $5M–$15M+ Revenue

These are larger, more complex businesses with bigger teams, stronger infrastructure, and higher profit margins. Ideal for buyers looking for significant income or a more strategic acquisition.

• $15M–$25M+ Deals

A smaller number of our clients go after these higher-value deals — often by partnering with investors or using advanced financing structures to minimise personal capital.

Whether you’re aiming to buy a solid cash-flowing business on the side — or a multi-million dollar operation — we show you how to source, structure, and secure the right deal for your situation.

Is this the Buyout Method specific to only certain types of businesses?

No — the strategies, tools, and support we provide are designed to work across a wide range of industries.

What matters most isn’t the type of business — it’s the quality of the business.

Our training focuses on how to identify, assess, and acquire well-established, profitable, cash-flowing businesses that can pay for themselves — whether they’re in services, manufacturing, health, trades, distribution, or other sectors.

We don’t specialise in just one industry — we specialise in helping you find the right business for you, then showing you how to buy it the smart way.

The principles are universal. The support is personalised. The network is diverse.

And how exactly do we find these profitable cashflow businesses?

We prefer to go off-market — because that’s where the best deals and best businesses are.

Off-market businesses aren’t listed publicly with brokers or on websites. They’re often owned by motivated sellers who are ready to retire or move on, but haven’t advertised the sale. This gives you a powerful advantage: less competition, better terms, and direct access to decision-makers.

We spend a great deal of time teaching our clients how to source these types of businesses the right way — using smart outreach strategies, professional positioning, and proven scripts to open conversations with owners in industries that align with your goals.

Finding the right business is not about chasing listings — it’s about creating opportunities.

I have never bought a business in my life — will this work for me?

Not at all. In fact, most of our clients are first-time buyers.

You don’t need an MBA, a finance background, or years of M&A experience. What you do need is the right strategy, support, and step-by-step guidance — and that’s exactly what we provide.

We specialise in helping everyday professionals buy profitable, established businesses the smart way — even if they’ve never bought a business before.

You’ll learn how to:

• Find the right type of business for your goals

• Understand financials (without needing to be an accountant)

• Structure offers with minimal upfront personal capital

• Negotiate directly with sellers

• Secure funding using creative strategies

So don’t worry about your experience level. We’ll walk you through the entire process — from sourcing to settlement — so you can make confident, informed decisions every step of the way.

How quickly can I buy my first business?

It depends entirely on you —but Let’s be real — this isn’t about buying any business. It’s about buying the right business. And that takes strategy, patience, and execution.

Most members start seeing meaningful traction — seller conversations, early offers, or even deals under contract — within 3 to 12 months. That’s the typical window. Not because the process is slow, but because we focus on helping you make smart acquisitions, not rushed ones.

That said, if you’re proactive — attending calls, reviewing deals, implementing the frameworks — you’ll likely make faster progress than most.

Some members have sourced leads and booked meetings in their first week. Others closed their first deal in month three. The difference isn’t luck — it’s implementation.

So how fast can you get results?

As fast as you’re willing to do the work — and as focused as you are on buying the right business.

How much money do I need to buy a business?

Our goal is simple: the Race to ZERO — to minimise how much of your own money you need to put in upfront.

Now, this doesn’t mean you get a business for free. What it means is that we structure the deal in a way that requires Minimal Upfront Personal Capital.

This is the key that makes business ownership accessible — even if you don’t have hundreds of thousands (or millions) sitting in the bank. Truth is, very few people do. That’s why we focus so heavily on deal structure.

We teach you how to use creative strategies — including seller finance, earn-outs, and funding the acquisition from the business’s own cash flow — so that the business can largely pay for itself.

With the right guidance, capital is no longer the barrier most people think it is.

Do you help with funding the deal?

Yes — we help you structure the deal in a way that makes funding possible, even if you don’t have large amounts of capital.

While we don’t provide funding ourselves, we show you exactly how to access it — using creative strategies like:

• Seller finance

• Earn-outs and staged payments

• Private lenders and investors

• Using the business’s own cash flow to fund the acquisition

We also help you prepare a compelling deal structure and connect you with funding partners, including finance brokers and lenders who understand acquisition deals.

So no, we don’t hand you the money — but we show you how to get the deal funded without needing millions of your own cash.

What kind of support do I get ?

You’re not doing this alone — far from it.

When you join, you get access to comprehensive, high-level support every step of the way:

✅ Expert Mentoring – Work directly with experienced advisors (including me) who’ve done deals and know how to navigate every stage of the process.

✅ Live Coaching Calls – Weekly calls to get your questions answered, workshop deals, and learn from real-life case studies.

✅ Deal Reviews – Submit potential deals for personalised feedback on valuation, structure, risks, and next steps.

✅ Templates & Tools – Access proven scripts, calculators, LOI templates, due diligence checklists, and deal structure models.

✅ Private Community – Connect with a network of buyers, ask questions 24/7, and get support, accountability, and encouragement.

✅ Deal Team Access – Get introduced to trusted lawyers, accountants, and financiers who understand acquisitions and know how to structure win-win deals.

In short, we remove the guesswork — and help you take confident, strategic action toward your first acquisition.

What if I can’t attend the weekly Deal Review and group coaching sessions?

That’s totally fine — you’re not required to attend every session.

These weekly calls are designed for when you have a deal you want reviewed, or if you’d like to learn by watching others go through real deal reviews. Many members simply attend when it’s relevant — and that’s exactly how it’s meant to work.

Can’t make it live? No problem. All sessions are recorded, so you can watch them in your own time and still get the full value.

It’s flexible, practical, and designed to fit around your schedule.

Is there one-on-one support, or is it only group coaching?

Yes — you’ll get personalised, one-on-one support on your deals.

When you’re working on a live opportunity, you can submit the deal for direct review and feedback. We’ll help you:

• Analyse the financials

• Assess the risks

• Value the business

• Structure the offer

• Plan your negotiation strategy

This isn’t generic advice — it’s tailored to your specific deal.

You’ll also have access to weekly live calls where we break down real deals, answer your questions, and guide you step-by-step through the acquisition process.

So while this isn’t a “done-for-you” service, you’re never left to figure it out alone. We’re in your corner at every stage.

How much time will I need to spend on buying a business?

You can make meaningful progress with as little as 1–2 hours per week.

This isn’t a full-time commitment — it’s a focused, strategic process. Most of our clients are busy professionals with jobs, businesses, and families. The key is consistency, not volume.

Early on, you’ll spend time learning the framework, sourcing opportunities, and connecting with sellers. As you progress, your time will be spent reviewing deals, running numbers, and negotiating terms.

We break the process down into simple, actionable steps — and provide the tools, scripts, and support so you can move efficiently without spinning your wheels.

Some clients move faster and commit more time. Others move steadily and still get results.

The bottom line? If you can set aside a few hours each week, stay consistent, and lean on the support — you can buy a business without burning out or putting your life on hold.

What happens after I buy? - Will you still provide support after I buy my business?

No — our focus is strictly on acquisitions, not on running or growing the business after the deal is done.

We specialise in helping you source, structure, and secure a profitable, cash-flowing business with minimal upfront personal capital. That’s where our expertise lies — and that’s where we deliver world-class support.

Once you take ownership, our role ends. We don’t offer ongoing support for operations, marketing, or growth strategy — because that’s a different discipline.

However, we can connect you with trusted mentors, consultants, and specialists in areas like marketing, sales, systems, and social media to help you grow and scale your business post-acquisition.

So while we don’t offer post-purchase support directly, we can point you to the right people who do.

Are there any upsells?

No — there are no upsells.

What you see is what you get. When you join, you get full access to everything you need: the training, the tools, the support, the calls, the deal reviews, and the community.

We don’t hold anything back or lock key content behind additional paywalls. There are no hidden upgrades, no “next level” programs, and no surprises.

We’re here to help you buy a business — not string you along with endless add-ons.

Are there any discounts?

No — we don’t offer discounts.

We believe in fair, transparent pricing that reflects the real value of the training, support, and expert guidance we provide.

This isn’t a volume-based, discount-driven program. It’s a high-impact mentoring experience designed to help you acquire a profitable business — and we treat it (and you) with that level of seriousness.

If you're ready to invest in the right support to buy a business the smart way, we're here to help you do it properly.

Are you based?

We’re based in Sydney, Australia, but we work with clients all across the country.

All of our training, support, and mentoring is delivered online — so whether you’re in Brisbane, Melbourne, Perth, Adelaide, or anywhere in between, you can access everything you need from wherever you are.

Our focus is on helping Australians buy Australian businesses — no matter where you’re starting from.

Does this work for Non-Australian markets?

The core principles and strategies we teach — sourcing off-market deals, structuring offers, using creative financing, and negotiating with sellers — are universal and can be applied in many countries.

However, the training is built primarily for the Australian market. That means:

• All legal, financial, and tax examples are Australian

• Funding strategies are tailored to Australian lenders and regulations

• Our network of lawyers, accountants, and deal professionals is Australia-based

We’ve had international members apply the strategies successfully in other countries — but you’ll need to adapt some aspects (particularly legal and financial) to your local market with help from professionals in your region.

If you’re based outside Australia, the content can still be valuable — just be prepared to localise certain parts of the process.

So what exactly do I get if I work with you?

It’s everything you need to go from “I know nothing about business acquisition” to becoming a confident business owner, investor, and entrepreneur.

We’re constantly improving the program, but as of July 1, 2025, here’s what’s included:

⸻

🔒 Private Community (Where the Magic Happens)

This is where deals are made, strategies are shared, and progress happens fast.

Our members are active across industries — from eComm, landscaping, and real estate to laundromats, hotels, bakeries, and professional services.

This isn’t a dead forum. It’s an active dealmaker’s network hosted in Slack — where members collaborate, partner, and hold each other accountable.

⸻

📞 Group Coaching & 1:1 Mentoring

Our calls are the heartbeat of the program where we.

• Review real deals in progress

• Share recent wins from members who’ve closed businesses

• Bring in guest experts (lenders, M&A lawyers, roll-up strategists, tax advisors, and more)

It’s hands-on, high-value, and highly practical — and yes, it’s a lot of fun too.

⸻

📄 Tools, Templates & Legal Docs

Get instant access to the essential documentation you need to assess, structure, and close deals:

• Cash Flow Calculator – Quickly assess whether a deal is worth pursuing

• Financial Modelling Tool – Forecast 3-year performance and plan your growth trajectory

• Legal Templates – Letters of Intent, NDAs, Due Diligence checklists, and more

• Proprietary Tools – Custom-built resources to de-risk your acquisition and move with confidence

⸻

🎓 Full Online Course (All-Access)

Think of it as an MBA you can actually use.

Work through 10 core step to buy just about any business from:

• How to find the right businesses

• Negotiation and deal structuring

• Funding strategies with minimal personal capital

• Your first 180 days as an owner

Plus, bonus trainings, with more added regularly.

⸻

This isn’t just theory.

It’s a full system to help you find, fund, and close your first (or next) acquisition — with real support every step of the way.

Why should I join you and not one of your competitors?

Great question — and one you should be asking.

Here’s why our clients choose us over other options:

1. Real Support, Not Just a Weekend Event

Unlike some programs that offer a 2- or 3-day crash course and then leave you on your own, we provide ongoing, hands-on support — including live coaching, deal reviews, personalised feedback, and access to a trusted deal team (lawyers, accountants, and financiers who know acquisitions).

2. Australian Focus

We’re based in Australia, and everything we teach is built for the Australian market — including deal structures, legal frameworks, funding options, and tax considerations. Most overseas programs simply don’t apply here.

3. Proven Process, Real Results

Our step-by-step system — Source. Structure. Secure. — has helped clients across Australia buy real, profitable, cash-flowing businesses with minimal personal capital. No hype. Just execution.

4. We Practice What We Teach

This isn’t theory. We’ve been involved in multi-million dollar deals across multiple industries and markets. We know what works — and what doesn’t — in the real world.

If you’re looking for a flashy seminar, there are other options.

If you’re looking for a clear roadmap, expert guidance, and the support you need to actually buy a business — that’s what we do best.

Finally, Do you guarantee success?

If you are the type of person who delegates your success to others, this is NOT for you. Let’s be clear – we cannot guarantee your success or earnings. No one can. In simple terms, your results are up to you, not us.

We can give you the recipe, but it’s up to you to source the ingredients and cook the meal. Think of us as Gordon Ramsay in the kitchen—correcting you if you’re about to slip up and cheering you on when you close your first deal.

If I decide to join, what are the next steps?

Here’s how the process works:

1. Book Your Strategy Session

This is where we map out your goals, answer your questions, and see if the program is the right fit for you (and if you’re the right fit for us).

2. Choose Your Payment Option

If you decide to move forward, you can select the payment plan that suits you best — we’ll walk you through the options.

3. Get Access & Onboard

Once you’re in, you’ll get immediate access to the platform, tools, and onboarding process — including all training materials, templates, and deal support resources.

4. Begin Your Training

You’ll start working through our proven step-by-step system: Source. Structure. Secure. — designed to get you making offers quickly and confidently.

5. Attend Weekly Coaching Calls

These live sessions are where deals are reviewed, questions are answered, and momentum is built. You’ll also have 24/7 access to our private community for ongoing support.

From Day One, you’ll be guided by a clear roadmap — and backed by expert mentorship and a supportive network focused on helping you buy your first (or next) business.

Discover how thousands of Australian Executives, Professionals, & High-Level Corporate Employees are SHIFTING away from the Corporate Grind, Do Deals, & Buy businesses -- Leveraging Their Experience, Connections, & Skills...

Sanjay Pandaram, CEO AND MENTOR

Who is Sanjay Pandaram...

Sanjay Pandaram is one of the most sought after Buy Side Advisors in the Australia

He is an accountant, investment banker, investor, business mentor and founder of the Business Buyers Institute - An Élite training organisation that teaches strategies used by investment banks & PE firms to buy highly profitable fully managed businesses without using their own money, risking their savings or buying the wrong business.

Sanjay Pandaram, often referred to as "The Acquisition Master", his impressive credentials include:

Certified Accountant (CPA )

Founder of the Business Buyers Institute

Macquarie Bank - Head of Finance (Australia)

Citibank APAC - Head of Strategy (US)

Lloyds International - Head of Performance (UK)

Rabobank - Financial Controller (Netherlands)

Commonwealth Bank - Executive Manger Corporate Banking (Australia)

Orix Corporation - Finance Manager (Japan)

You don't have a money problem... You have a knowledge problem. We can solve that

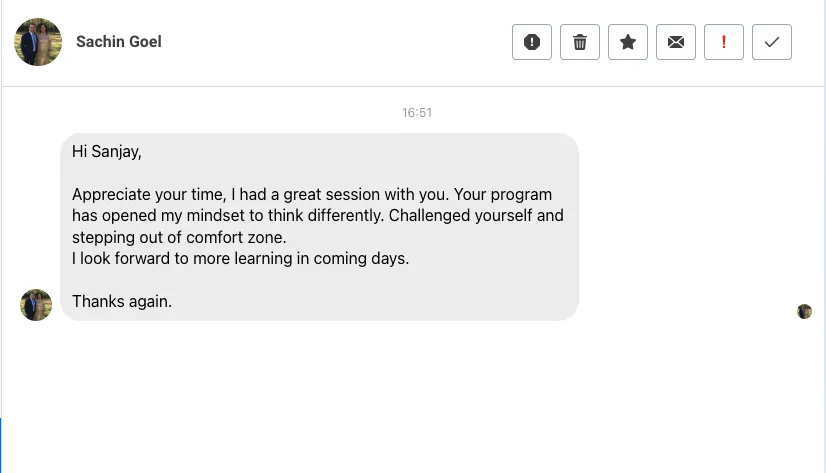

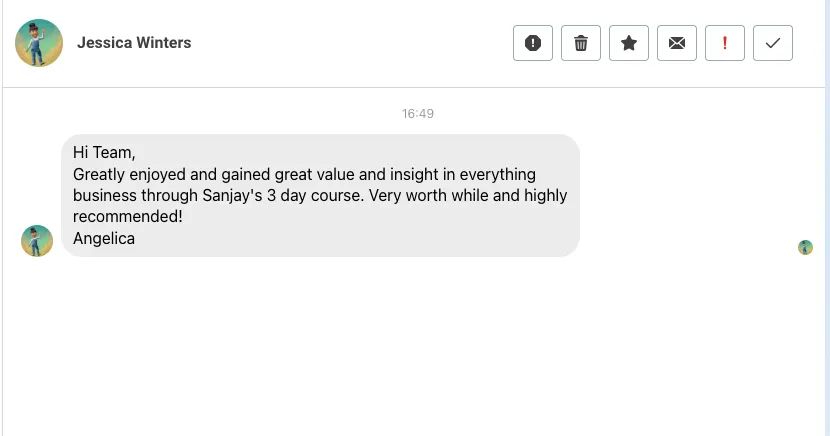

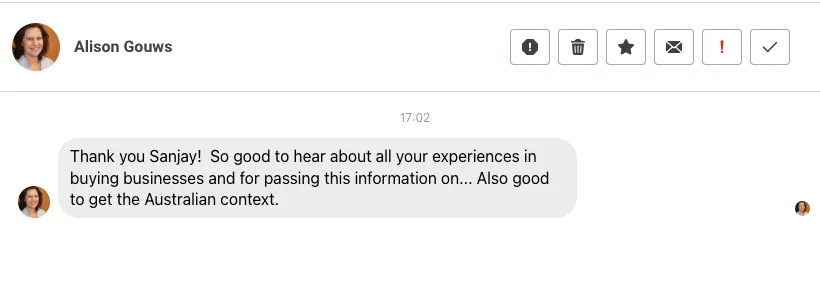

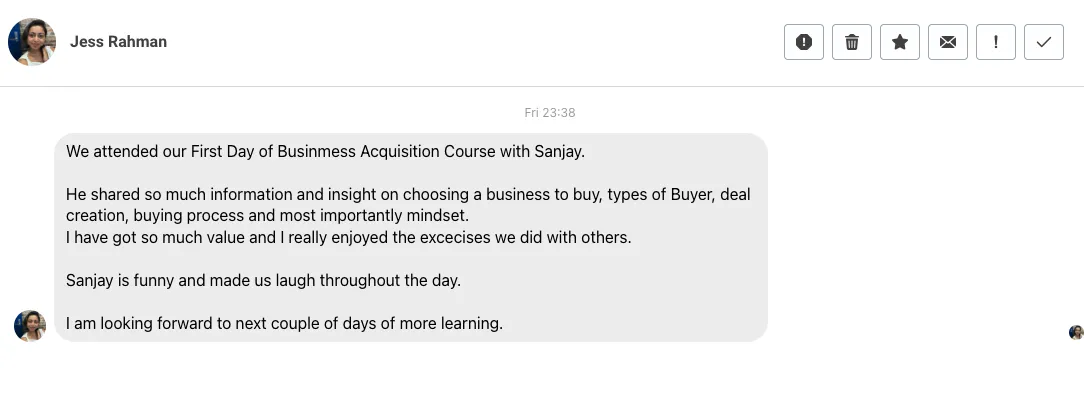

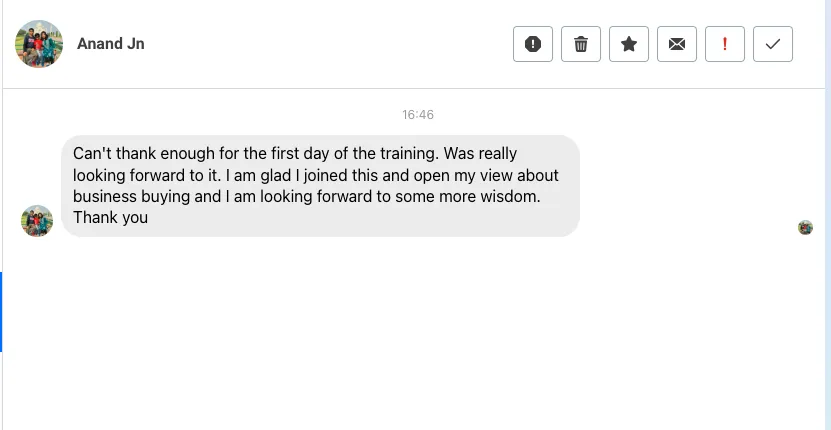

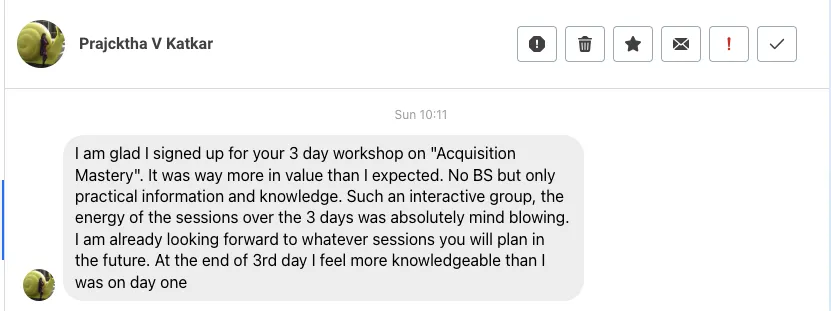

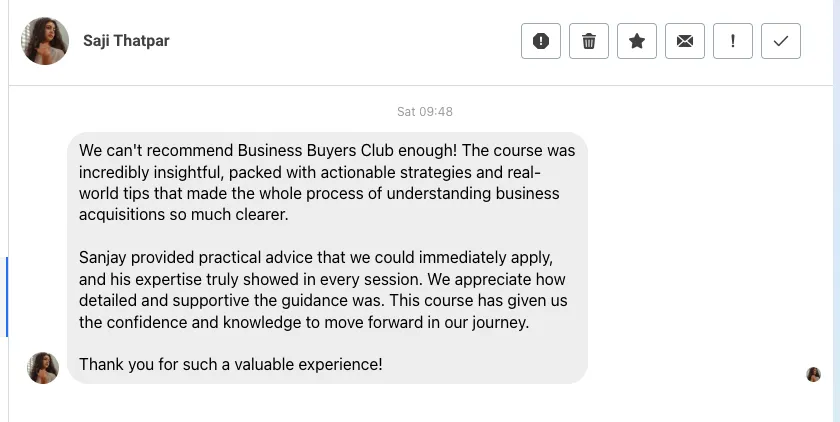

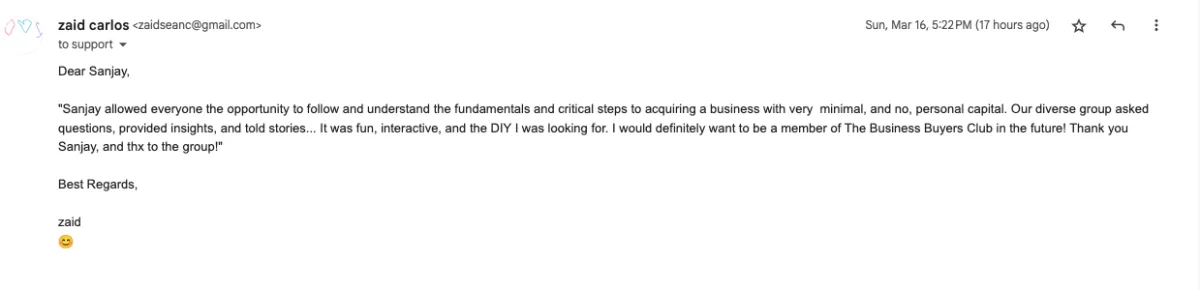

What Our Students Say...

For Everyday Aussies Who Want To Get Into Business... Without Buying Job... or Risk Their Savings

(actually create Financial Freedom))

you are

Unsure of WHAT to Buy

WANT professional guidance

Unsure of the buying process

Afraid of making a costly mistake?

wanT To Create a new income stream

don't have all the asking price

Don't want to buy a job

don't want to spend a tonne of professional fees

want to learn

Further Endorsements from Those We’ve Mentored

Your strategies helped me buy a No Money Down business!

Following your advice has resulted me to acquire my 1st 'No Money Out Of Pocket' business. Thanks for the continued support.

⭐️ ⭐️ ⭐️ ⭐️ ⭐️

Aaron S.

Your workshop gave me the clarity I was seeking

This was a wonderful workshop! It's the clarity I was seeking. Now I know what I need to do. Thanks for all the great training you put on.

⭐️ ⭐️ ⭐️ ⭐️ ⭐️

Colleen P.

Trainings that provided REAL value & actionable steps!

You guys CRUSHED the training today. I can honestly say that you guys genuinely care about the results we get. You guys are just amazing.

⭐️ ⭐️ ⭐️ ⭐️ ⭐️

Greg S.

You guys doing something no one else is doing!

I must say, you doing something no one else is doing. What you showed me was a real eye opener. I wish I had learnt this when I was younger... but better late than never...

⭐️ ⭐️ ⭐️ ⭐️ ⭐️

Cathy T.

I just bought my very first business...

I've been looking for the best way to get into business. With your help, I bought a new business.... with no money from me! This has changed my life forever and I can't thank you enough.

⭐️ ⭐️ ⭐️ ⭐️ ⭐️

Jenny D.

The future for my family and me looks bright

I came to here with my family because we wanted a better life. And have a better lifestyle. What you guys taught me has enabled me to realise that dream. Thank you. Thank you. Thank you

⭐️ ⭐️ ⭐️ ⭐️ ⭐️

Rajeev S.

I learnt more from your presentation than I did at Uni...

The business classes I took at Uni are a joke compared to what you teach. Seriously. This is a game changer for me. Real. Practice. Concise.

⭐️ ⭐️ ⭐️ ⭐️ ⭐️

Mike P.

Thanks so much for an awesome workshop

Thanks so much for the fascinating workshop today. I've been looking for something like this for a very long time... and finally I found you guys

⭐️ ⭐️ ⭐️ ⭐️ ⭐️

Wendy D.

Why don't they teach this stuff at school instead of crap

This is real education. This is what people need to learn. I wish the Government would have you guys teach this in schools

⭐️ ⭐️ ⭐️ ⭐️ ⭐️

Ryan R.